Conclusion: the impact of the introduced sanctions on the russian economy is insufficient to end the war. It is necessary to create a Second Economic Front.

ANTS experts within the framework of the project “russian Assets as the Source to Restore the Ukrainian Economy” with the support of the National Democratic Institute (NDI) are conducting expert-analytical studies on the economic effectiveness of the introduced sanctions.

The analyst of the project, Doctor of Economics, Professor Lidia Lisovska believes that the expansion of sanctions to be implemented by Western countries should affect the potential of russia’s financial system, as well as those sectors that provide significant revenues to the budget of the aggressor country.

To justify the conclusions, let’s turn to a comparative analysis of some macroeconomic indicators in the cross section of countries. For comparison, we used IMF and EU data, but for russia’s indicators, we used growth data and data from the Central Bank of Ukraine report.

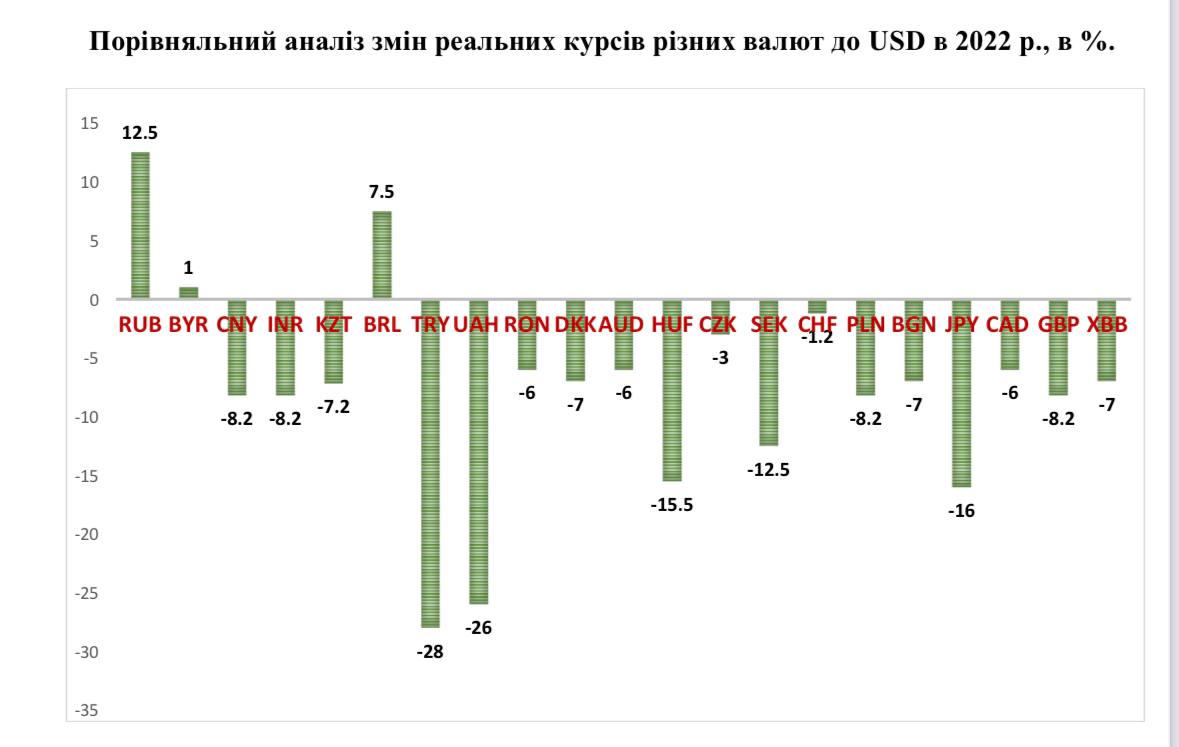

These charts show the decline in the exchange rate of most world currencies against the US dollar. So, in particular, in 2022, the hryvnia of Ukraine lost more than a quarter of its weight in response to the full-scale military invasion of russia on the territory of Ukraine. Further devaluation of the hryvnia was stopped thanks to the policy of the National Bank of Ukraine and the financial assistance of Ukraine’s partner countries.

And what was the situation with the ruble?

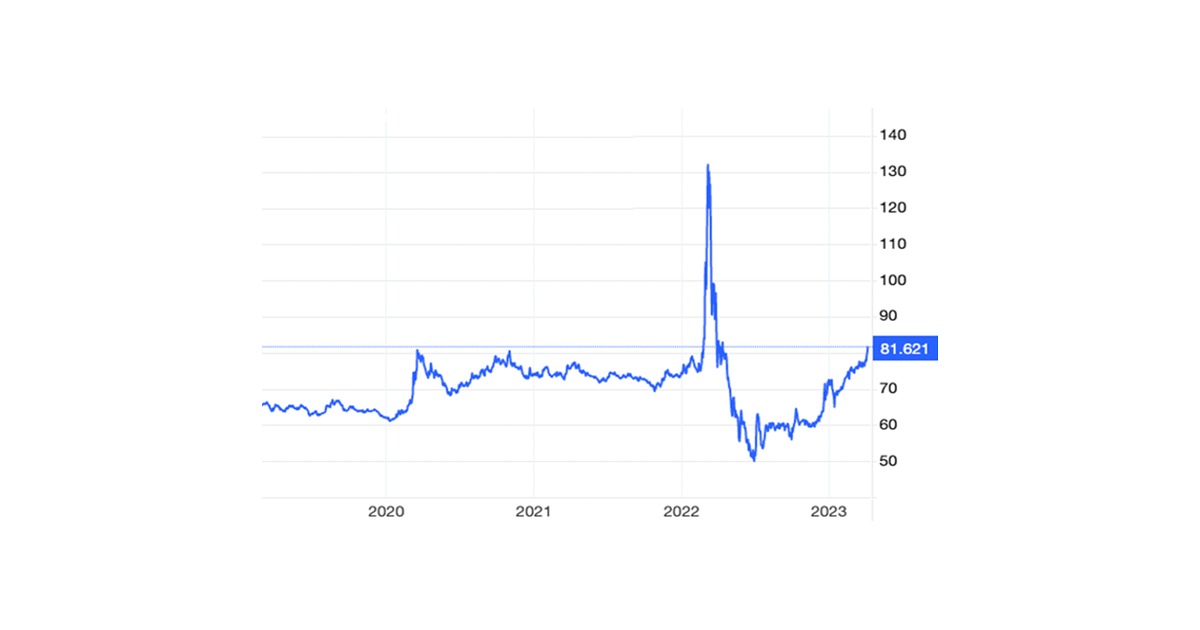

The dynamics of the exchange rate of the russian ruble against the US dollar

The dynamics of the ruble exchange rate in 2022 was mainly influenced by sanctions restrictions and their consequences.

Sanction pressure significantly weakened the ruble in the first weeks after the introduction of sanctions against the Central Bank of the russian federation and the disconnection of seven russian banks from SWIFT. In the first week of March 2022, the ruble rate on the stock market reached 137.85 russian rubles per US dollar, which is the lowest in the last year and below the levels that preceded the invasion of Ukraine, against the background of reduced inflows of foreign currency and increased demand for foreign currency in russia. After the sanctions decisions of democratic countries froze part of the international reserves of the Central Bank of russia, the possibilities of conducting currency interventions to support financial stability were limited. Foreign currency inflows to russia remained negligible as sanctions resulted in Urals oil trading at a significant discount to peers.

In the first weeks after the introduction of sanctions, the Bank of russia took radical measures: a sharp increase in the key rate, the suspension of trading on the stock exchange, restrictions on the cross-border movement of capital, regulatory relaxations for banks and other financial institutions.

In the II quarter of 2022, a decrease in import volumes and high energy prices, which supported exports, led to an increase in the current account surplus of the balance of payments, which, in combination with restrictions on financial transactions, allowed the Central Bank of the russian federation to maintain the ruble exchange rate.

In the III quarter of 2022, the strengthening of the real exchange rate of the ruble slowed down in the context of a decrease in the current account surplus, which happened with a certain recovery of imports (due to the use of the Chinese yuan) and a reduction in exports.

In the IV quarter, the real exchange rate of the ruble began to decline.

In general, during the year, the russian ruble nominally strengthened against the US dollar by 5.3%, against the euro – by 10.0%, against the yuan – by 15.1%.

In some strange way, in the report for 2022 submitted to the State Duma of the russian Federation, the Central Bank of russia was able to calculate that by the end of 2022, the real effective exchange rate of the ruble had grown by 26%.

russia’s statistics may be distorted and may not reflect the actual state of affairs. However, many data from other information sources also do not add optimism about russia’s loss of desire to wage a bloody war.

All democratic countries should create a Coalition for the opening of the Second Economic Front, which should force russia to stop the war against Ukraine and the democratic world in general and free the entire territory of Ukraine from its occupying forces.

The project “russian Assets as the Source to Restore the Ukrainian Economy” aims to organize a number of other activities that will contribute to raising public awareness of the importance of confiscating russian assets for the restoration of the Ukrainian economy.