Russia’s war against Ukraine has been a major challenge for its economy. Since the start of the full-scale invasion, Russia has been under extreme pressure from international sanctions, the frozen foreign exchange reserves, Europe and Ukraine’s Western partners’ refusal to buy Russian energy, restrictions on foreign trade, capital withdrawals and rapid growth in military spending.

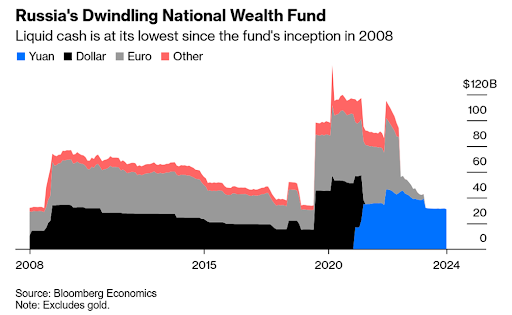

These strikes were unprecedented, but the significant increase in oil and gas prices in 2022 provoked by Russian aggression, the reserves accumulated in the National Welfare Fund (NWF) over the past years, and the willingness of China and India, in particular, to buy Russian energy and supply their goods and technologies instead of Western ones, made it possible to withstand and put the Russian economy on a war footing.

In 2023–2024, oil prices dropped considerably, although they did exceed the price cap, resources from the NWF declined significantly, and secondary sanctions from Western partners, primarily the EU and the US over the past year, limited the ability to circumvent them. All of this has largely exhausted the Kremlin’s economic base, which in turn has reduced the ability to fiscal stimulus. Although military budget expenditures are growing every year, the cost of this growth is inflation, devaluation, investment restrictions, a decrease in unemployed labour and a cooling economy.

Despite the obvious distortions and crisis conditions, the information space often features the thesis of allegedly opposition Russian economists about the “resilience” of the Russian economy and its ability to support the aggression for years. Is this thesis true or is it just another tool of Russian propaganda, and to what extent is the Russian economy objectively resilient?

First of all, it should be noted that since the beginning of the war in 2022, the aggressor has restricted significant sets of statistics, the analysis of which would allow an objective assessment of the Russian economy and the ongoing processes. Regarding the small amount of the published information, a comparison with other publicly available official data reveals significant discrepancies, in particular with regard to a key macroeconomic indicator such as the official inflation rate, which does not comply with any alternative calculation, particularly, the expected inflation rate estimated by the Central Bank of Russia, as well as the growth rate of consumption taxes in 2023–2024, which depends on the price index.

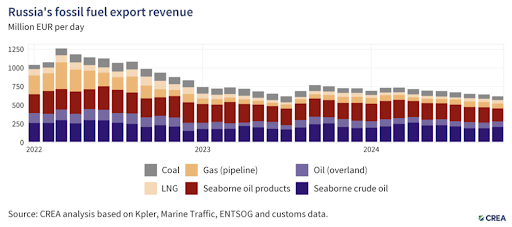

Second, despite the fact that the sanctions did not cause a catastrophe in the Russian economy, they have seriously limited its revenues and opportunities for economic growth. In 2023 alone, export revenues fell by $170 billion, due to price restrictions and Western countries’ refusal from buying Russian oil and gas.

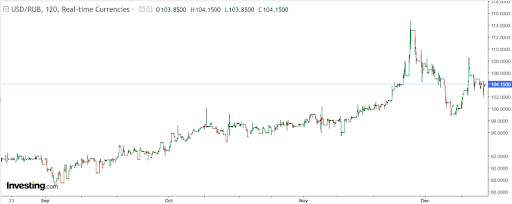

Third, the sanctions also strongly impacted the stability of the Russian ruble, leading to new all-time highs.

The Russian stock market has been falling down for over six months and has dropped by almost 30%. Stocks of Gazprom, Russia’s largest company, have reached their lowest level on record.

At the end of 2024, the budget deficit amounted to about RUB 3.5 trillion (USD 35 billion), which was covered by the NWF and the issue funds that the Russian budget raised from the Central Bank through Russian banks through repo transactions. In just three years, the monetary supply of M2 in the economy increased from RUB 66.7 trillion to RUB 108.9 trillion.

Foreign exchange reserves, considered to be an essential safety cushion, are almost exhausted. The liquid assets of the National Welfare Fund of Russia dropped from $140 billion in February 2022 to $53.8 billion at the end of December 2024, and now consists only of yuan, which significantly limits the ability to cover imports and defence spending.

Fourth, the biggest problem for the Russian economy is the shortage of labour resources. The unemployment rate is at a minimum level, which leads to a higher rate of wage growth than the rate of labour productivity growth, provokes higher inflation, and limits the rate of economic growth. Mobilisation, luring workers to the military-industrial complex, and emigration have made it impossible to increase production in a non-war economy. By all accounts, Russia is living on borrowed time, spending its last reserves.

But will the Kremlin be able to continue financing the war in 2025? There are several factors that can affect the answer to this question. First, the budget’s energy dependence on oil and gas exports makes Russia extremely vulnerable to price fluctuations. If the price of oil falls below $50 per barrel, the economic losses will be critical.

Moreover, the ruble emission aimed to cover the budget deficit will continue to accelerate inflation. The inflation rate is expected to reach 30% by 2025, destroying the remaining purchasing power of the population.

Finally, limited access to Western technology and investments is exacerbating the structural crisis.

How to accelerate the collapse of the Russian economy?

Currently, the international community must increase pressure on the aggressor. The primary task is to create effective mechanisms to avoid circumventing sanctions. Among other things, the “shadow fleet” of tankers used by Russia to export oil in violation of the restrictions should be stopped. Russia’s frozen assets worth $300 billion should be confiscated and used to rebuild Ukraine and fund its defence. Such action would not only hit the Russian economy, but also send a clear signal that responsibility for the aggression is inevitable.

Ukraine should also continue to advocate for stronger sanctions and emphasise the significance of economic pressure on Russia. It is crucial to convey to the international community that Russia’s economic weakness is the key to our victory. History proves that the Kremlin understands only the language of force, therefore this principle should be the basis of policy towards it.

In fact, stopping the transit of Russian energy resources through Ukraine would deal a serious blow to the main sources of revenue for the Russian budget, limiting foreign exchange earnings and reducing the ability to finance the war. The energy sector is key for Russia, and stopping transit would send a strong signal to the international community about Ukraine’s resolve.

Since 1 January 2025, the transit of Russian gas has been stopped, but Russian oil continues to bring about $6 billion to the Russian budget. This step is aimed not only at weakening Russia’s economy, but also at strengthening Ukraine’s position in international diplomacy. Notably, such a move could further isolate the Russian economy, as a reduction in transit would make it impossible for Moscow to use energy leverage.

When will Russia’s economy collapse?

Russia’s economy is already in deep crisis, and the Kremlin does not have the resources to sustain the war. In recent years, sanctions have reduced its export capacity, while the ruble’s emission and the rapid increase in military spending have led to serious imbalances. Foreign exchange reserves are depleted, dependence on oil and gas exports remains critical, and energy prices are increasingly subject to geopolitical decisions and market fluctuations. If the oil price falls below USD 50 per barrel and remains at this level for a sufficiently long period, Russia will lose the ability to finance its aggression against Ukraine.

The high inflation rate, which could reach 30% in 2025, will increase social tensions and reduce the purchasing power of the population. At the same time, the structural dependence on imported technologies and components limits the development of even critical industries.

***

The international community has all the necessary tools to accelerate Russia’s economic collapse. Tougher sanctions, confiscation of frozen assets, suspension of energy purchases by Western countries, and effective control over compliance with sanctions and restrictions could further weaken the Kremlin. An effective information campaign will help convince the international community that such actions are appropriate. All these measures will not only accelerate Ukraine’s victory, but also create a more stable future for international security.

Ilya Neskhodovskyi, economics expert, ANTS NGO